New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

Analyze information

Analyze information

The News flow simulation helps you to get started with financial markets. As a SimTrader, your goal in this simulation is to analyze the news flow: for each event, you can study its impact on the firm value and decide about your trades (to buy, sell or do nothing). At the start of the simulation, you own an account worth €50,000 in cash and 1,000 NutriFood shares. The News flow simulation will be the opportunity to discover the mechanisms of a financial market: the limit order book, market orders ("MKT" orders) and limit orders ("LMT" orders). The duration of the simulation is initially set to five minutes, which corresponds to a 24-hour trading day. Using the timeline of the simulation, you can increase or decrease the simulation speed at any time. |

Your grade for this simulation (100 points) takes into account the following elements:

If you launch the simulation several times, the simulation grade retained is the best grade you obtained on all the simulations (grade which takes into account your trading performance, your trading activity and your MCQ test for each simulation). |

|

NutriFood is a large firm in the Food and Beverages (F&B) sector. NutriFood operates several chains of bio fast-food restaurants in main cities in Europe, Canada and Latin America. Each of these chains cater to all ages, from teenagers to senior people. NutriFood was initially a small family firm, founded in Normandy in the early 1950s. The corporate headquarters of NutriFood are in the Parisian region. |

|

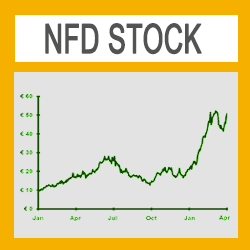

After several decades of rapid growth, NutriFood had a successful initial public offering (IPO) in 2005. Since its introduction in the stock market, the stock price of NutriFood (code: NFD) has steadily increased from its introductory price of €35. NFD shares are quoted both in Paris and New York stock exchanges. NutriFood is one of the top firms in the Food and Beverages (F&B) industry in Europe. NFD shares are currently priced at approximately €50. |

|

Today, the stock price of NutriFood shares should evolve according to the news flow, and the supply and demand for the shares. At 6:00 am, the government will release the Household Confidence Indicator (HCI) for the last quarter. The HCI has longtime been considered a reliable leading indicator of future economic activity. Thus, a decrease in the HCI would forecast slow economic growth, while an increase in the HCI would forecast fast economic growth. The market consensus about the HCI is its stability (i.e. 0-point change). However, some financial analysts debate about two possible scenarios: a 2-point increase or a 2-point decrease. Which will be the HCI figure for today? At midday, NutriFood will organize a meeting with financial analysts and should announce the amount of sales for the last quarter. For financial analysts following NutriFood, the expectation is €450 million. What will be the amount of sales announced by NutriFood? Later in the day, the Ministry of Education will announce the result of a public tender to provide bio food for canteens of all French public schools. NutriFood participated to this tender and is waiting with great interest the results. Depending on the result of the public tender, given the business at stake, the price of NutriFood shares should fluctuate strongly upwards or downwards. According to the market consensus, if NutriFood wins the bid, this will result in substantial profits and the stock price will then stand at approximately €55-60. If NutriFood loses the bid, the company will remain subject to the evolution of the business cycle and its stock price is expected to fluctuate around €40-45. Will NutriFood win the bid? |

The News flow simulation focuses on the basics of the market: the limit order book and how to send orders to the market. Teaching goals: the News flow simulation will be the opportunity to understand a market with buyers and sellers, and the supply and demand. How the market will react to your orders? Learning objectives: this simulation will help to learn the following elements of trading:

Before or after launching this simulation, you can learn more about financial markets by taking courses related to the simulation. Download the case note to help you during the simulation. |

|

Professor François Longin “You're just a click away from sending your first order to the market.” |