New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

Food for future generations

Food for future generations

The NutriFood simulation allows you to experience a day of trading in financial markets. During the simulation you will receive news about NutriFood, a company whose shares trade in the stock exchange. You will be able to buy and sell shares of NutriFood via the SimTrade platform. Your goal is to maximize your trading gain at the end of the simulation. At the start of the simulation, you own an account consisting of €50,000 in cash and 1,000 NutriFood shares. Given yesterday’s closing price of €50.15, the total value of your position is more than €100,000. The duration of the simulation is initially set to 10 minutes (which corresponds to a 24-hour day). Using the timeline, you can increase or decrease the simulation speed at any time. You must complete the simulation for it to be valid. You can restart the simulation as many times as you wish. |

Your grade for this simulation (100 points) takes into account the following elements:

|

|

NutriFood is a large firm in the Food and Beverages (F&B) sector. NutriFood operates, either directly or through franchisees, several chains of bio fast foods in many cities in Europe, Canada and Latin America. Each of these chains, under different brands, cater to all ages, from teenagers to senior people. NutriFood was initially a small family firm, founded in Normandy in the early 1950s. The corporate headquarters of NutriFood are in the Parisian region. |

|

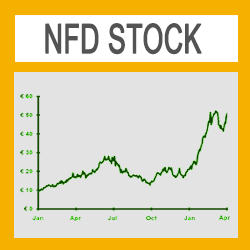

After several decades of rapid growth, NutriFood had a successful initial public offering (IPO) in 2005. The founding family only kept a 3% stake in the firm. Since then, the stock price of NutriFood (code: NFD) has steadily increased. From its introductory price of €35 in 2005, NFD stock is now around €50. NFD shares are quoted both in Paris and New York stock exchanges. NutriFood belongs to the European F&B 100 index, which includes the top firms in the Food and Beverages (F&B) industry in Europe. The NFD stock is currently priced around €50. |

|

|

Today is an important day, as NutriFood will hold its annual General Meeting. The CEO of NutriFood will announce the profits for the last year. The market consensus is an annual profit of €320 million for NutriFood. Besides, public opinion remains shocked by the tsunami that ravaged the French Atlantic coast during the last week. The most important damage happened to the Mont Saint-Michel, which is an icon of the French culture. Unless an urgent reconstruction effort comes soon, most buildings of the Mont Saint-Michel may collapse. Consequently, the French State has set up a Super Fund to finance the massive cost of reconstruction of the Mont Saint-Michel. Many companies, both in France and abroad, have already volunteered to contribute to this fund. There is speculation that at the beginning of General Meeting, the CEO may announce a firm donation to the Super Fund. This rumor is plausible, as some of NutriFood competitors have already announced their willingness to donate to the reconstruction fund. However, companies vary in their level of commitment. Less generous companies are giving out relatively small amounts of money -around €1 million-, while more generous companies are giving out up to €100 million. Which path will NutriFood take? Investors are also aware that today the government releases the Household Confidence Indicator (HCI) for the last quarter. The HCI has longtime been considered a reliable leading indicator of future economic activity. Thus, a decrease in the HCI would forecast slow economic growth, while an increase in the HCI would forecast rapid economic growth. The market consensus about the HCI is its stability (i.e. zero change). However, some financial analysts debate about two possible extreme scenarios: a 2-point increase or a 2-point decrease. Finally, the new composition of the 100 Global Sustainability Index will be announced by the end of the day. For a firm, to be part of this index is widely seen as a recognition of its sustainable performance. There is a rumor that NutriFood could be included for the first time in this index. |

Teaching objectives: the NutriFood simulation will enable you to become familiar with the key concept of market efficiency and how the news flow impacts the evolution of financial assets market prices. You will also discover key determinants of success for a company in the Food and Beverages sector. Learning goals: the NutriFood simulation will also allow you to learn the following skills:

Before or after launching this simulation, you can learn more on information in financial markets by taking related courses to the simulation. |

|

The data regarding your trading activity during the NutriFood simulation will be used as part of a behavioral finance research project developed by Prof. Longin and Prof. Zicari, at ESSEC Business School. The goal of this research project is to investigate the behavior of individuals in response to the news flow. The data of the simulation and the survey will be used anonymously. |

|

Professor Adrian Zicari

|

|

Professor François Longin

|