New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

Understand the risks of a wheat producer

Understand the risks of a wheat producer

|

The When the plague falls down simulation is the follow up to the Harvest time and The price of wheat simulations. These simulations dealt with factors internal to the company (such as the quantity of wheat harvested) and external factors (such as the price of wheat) affecting the BDF stock price. The When the plague falls down simulation is concerned with both internal and external factors influencing Blé de France. At the start of the simulation, you own an account worth €100,000 in cash and 1,000 Blé de France shares. As a SimTrader, your goal in this simulation is to maximize your trading gains. In this simulation, you can send all types of orders to the market: market orders (MKT), limit orders (LMT), best limit orders (BL), stop orders (STP) and stop limit orders (STL). The duration of the simulation is initially set to 10 minutes, which corresponds to a 24-hour trading day. Using the timeline, you can increase or decrease the simulation speed at any time. |

Your grade for this simulation (100 points) takes into account the following elements:

If you launch the simulation several times, the simulation grade retained is the best grade you obtained on all the simulations (grade which takes into account your trading performance, your trading activity and your MCQ test for each simulation). |

Blé de France is a French wheat producer. The firm was created in 1780 by the Turgot de la Beauce brothers, nephews of the famous financial controller of the King of France Louis XVI. The firm is still managed by a descendant of the founders, Charles-Louis Turgot de la Beauce, who is an emblem of the cereal industry in France. Blé de France fields are mainly located in the Beauce area in the center of France. The sales structure is composed of two parts:

|

|

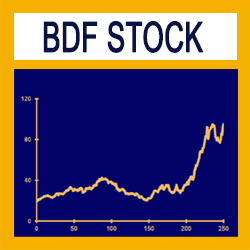

The ticker symbol for Blé de France shares traded on the market is BDF. Blé de France was introduced in the French stock market in the 1970s. During the past few years, its stock price soared. This strong price increase can be partly explained by the strong increase in the wheat prices at the world level. For a few weeks, the BDF stock price has been very volatile. The stock price has indeed dramatic variations according to the news that has arrived on the market: announcement of the benefits of the company, natural events affecting the price of wheat, change of the economic and regulatory environment, etc. |

|

Traders will continue to watch closely the evolution of the price of wheat, which has a significant impact on the stock price of BDF shares. Indeed, if Blé de France has signed multi-year contracts with major agri-food companies, it sells a significant part of its harvest on the international wheat market. A dozen financial analysts follow BDF stocks and participate in the market consensus. The market anticipates a harvest of 8 Mt of wheat for Blé de France. The price of wheat is currently €300 per ton but the market is experiencing some volatility. According to the consensus, the average target price for BDF shares is €125. What will happen next? How will the market react to the news? And especially how will you react? Those are the questions... |

The World Cereals (WC) investment fund has developed a model that links BDF stock price to the price of wheat and the quantity of wheat harvested by the Blé de France company. This model takes into account the structure of the company's turnover, that is to say the sales from multi-year contracts at fixed prices and quantities, and the sales of the rest of the harvest on the international wheat market at a market price which varies over time. The stock price estimate takes into account the current year's profit, which depends on the current price of wheat, and the profits of the following years, which include a long-term value for the quantity harvested and for the price of wheat. The table below presents the estimation results produced by the WC model. It gives the BDF stock price estimates for different values of the price wheat and the quantity harvested by Blé de France (the values of the price of wheat and the quantity wheat harvested are values that may see in the near future).

|

|||||||||||||||||||||

The When the plague falls down simulation is interested in the information about the company and its interpretation by the market. What is the relevant information about the company? How is this information interpreted by the market? What is information incorporated in the stock price? This simulation looks at a key concept in financial markets: information. Teaching goals: the When the plague falls down simulation will be the opportunity to understand deeper how information is incorporated by the market. Learning objectives: this simulation will help you to learn the following elements of finance:

Before or after launching this simulation, you can learn more on information in financial markets by taking related courses to the simulation. Download the case note to help you during the simulation. |

|

Gabriel Eschbach « The key is knowing how to process information. The market is anticipating what will happen, but things never happen as expected. The market reacts to the rumor and adjusts to the news. And you! What do you expect? How will you react? What are you going to do? » |

|

Professor François Longin « Before starting the simulation, remember that the market is always right; and that the market is always right even when it is wrong... » |