New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

How to send market orders

How to send market orders

At the start of the simulation, you own an account worth €10,000 in cash and 1,000 BestPizza shares. As a SimTrader, your goal in this simulation is to hold at least 2,000 BestPizza shares at the end of the simulation. The Market orders simulation will be the opportunity to discover market orders ("MKT" orders) to trade in financial markets. In this simulation, you will be allowed to send only market orders. The duration of the simulation is initially set to five minutes, which corresponds to a 24-hour trading day. Using the timeline, you can increase or decrease the simulation speed at any time. |

Your grade for this simulation (100 points) takes into account the following elements:

If you launch the simulation several times, the simulation grade retained is the best grade you obtained on all the simulations (grade which takes into account your trading performance, your trading activity and your MCQ test for each simulation). |

BestPizza is a restaurant chain in France, which has been doing business since the 1960s. Building on its strong reputation, the chain has more than 100 restaurants spread in the Paris area and other regions. The development of the company took place gradually even though the recurrence of economic crises had a negative impact on the number of customers. BestPizza was initially founded by two Italian partners and was introduced on the stock market in the early 2000s. |  |

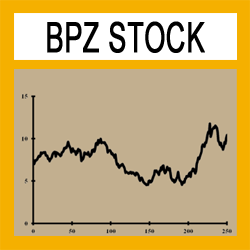

The ticker symbol for BestPizza shares traded on the market is BPZ. The BPZ stock price has stayed around the same level as its introductory price of €10 in 2000. If the stock price hasn't increased, it is worth noting that the BestPizza company has continuously distributed dividends to its shareholders. Over the recent period, the stock price has fluctuated around €10 depending on the bad news and the good news about the company, the food service sector and the economy. |  |

The stock price of BestPizza shares should evolve according to the news flow, and the supply and demand for BPZ shares. The publication of the consumer confidence index (CCI) at 12:00 will be followed with great interest by all market participants. This economic indicator comes from a business survey of households (questions on their financial situation, standard of living, professional status, ability to save, and their perspective on the future). This opinion indicator reveals the confidence of households in the economic environment and provides information on their behavior as consumers and savers. The consumer confidence index is highly correlated with restaurant attendance and has a strong impact on the valuation of catering companies. Some analysts anticipate a drop in the consumer confidence index while others anticipate a rise; the market consensus expects the index to remain stable (variation of 0 point). The market will also pay attention to the recommendations of the financial analysts following BestPizza stocks. |

The Market orders simulation focuses on a particular type of exchange orders: market orders ("MKT" order). Teaching goals: the Market orders simulation will be the opportunity to understand deeper how a market with a limit order book works. How do buyers and sellers meet to trade with each other? What is the supply and demand in such a market? How does the limit order book interact with market orders? How does the limit order book evolve over time? How does a transaction happen? How are prices determined in such a market? How does the market react to your market orders? Learning objectives: this simulation will help you to learn the following elements of trading:

Before or after launching this simulation, you can learn more on the market orders by taking related courses to the simulation. Download the case note to help you during the simulation. |

|

Professor François Longin « The main interest of a market order ("MKT" order) is to control the quantity of shares that you want buy or sell. On the other hand, sending a market order to the market can have a significant impact on the execution price. » |