New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

BitCoin

BitCoin

The BitCoin simulation allows you to experience a day of trading in crypto markets. During the simulation, you will receive news about Bitcoin, a cryptocurrency traded on the SimTrade platform. You will be able to buy and sell Bitcoin. Note that Bitcoin is divisible and you can buy and sell portions of Bitcoin on the SimTrade platform (like 0.55 bitcoin). Your goal is to maximize your trading gain at the end of the simulation. At the start of the simulation, you own an account consisting of €50,0000 in cash and 2 Bitcoins. Given yesterday’s closing price of €25,101, the total value of your position is nearly €100,000. The duration of the simulation is initially set to 10 minutes which corresponds to a 24-hour trading day. You must complete the simulation for it to be valid for your grade. |

Your grade for this simulation (100 points) takes into account the following elements:

|

|

Bitcoin was first introduced in 2008 as a decentralized currency without the need for a central bank or any intermediaries. It can be sent to and from users via the bitcoin network, a peer-to-peer network in which transactions are authenticated by nodes and recorded on a blockchain. The transactions of Bitcoin are hard to be reversed and faked based on the use of a distributed accounting ledger technology. Bitcoins are not backed by the government or any issuing institution, and there is nothing to guarantee their value besides the proof baked in the heart of the system. |

|

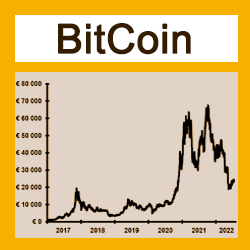

Among asset classes, Bitcoin has one of the most volatile trading histories. Bitcoin had a price of zero when it was introduced in 2009. It witnessed strong gains and suffered equally rapid deceleration for several years. In 2017, Bitcoin's price hovered around $1,000 until it broke $2,000 in mid-May and then skyrocketed to $19,345.49 in December. Mainstream investors, governments, economists, and scientists took notice, and other entities began developing cryptocurrencies to compete with Bitcoin. In 2020, the economy shut down due to the COVID-19 pandemic. Bitcoin's price burst into action once again. The pandemic shutdown and subsequent government policies fed investors' fears about the global economy and accelerated Bitcoin's rise. Bitcoin's price reached just under $29,000 in December 2020, increasing 416% from the start of that year. Bitcoin prices reached new all-time highs of over $60,000 in 2021 as Coinbase, a cryptocurrency exchange, went public. When the emergence of a new variant of COVID-19 continued to spook investors recently, Bitcoin dropped below $23,000 for the first time since December 2020. Bitcoin are currently priced at approximately €25,000. |

|

|

Today is an important day for Bitcoin, the People’s Bank of China (PBOC) will declare a series of measures aimed at cryptocurrency transactions. Investors are very concerned whether the bitcoin will be banned. It is possible that the price of bitcoin will be influenced dramatically by the attitude of the Chinese government. Late morning, Tesla will announce its new policy for bitcoin payments. What will Tesla do: use or not use Bitcoin for payments. How about the change of Bitcoin prices after their announcement? Around 2 PM, the Federal Reserve will release a report on the crypto markets. According to the position of the Fed, it may be positive or negative for the Bitcoin market. Finally, there is a continuous concern from investors about the security of crypto exchanges. The threat of cyber attacks represents high operational risk and undermines the confidence of investors in the market. How about the impact on market confidence and bitcoin price? The market price of cryptocurrencies regularly crashes after the announcement of cyber attacks. |

Teaching objectives: the Bitcoin simulation will enable you to become familiar with the key concept of market efficiency and how the news flow impacts the evolution of crypto assets market prices. You will also discover key determinants of price change for a decentralized digital currency in the crypto market. Learning goals: the Bitcoin simulation will also allow you to acquire the following skills:

Before or after launching this simulation, you can obtain additional information on the financial markets by taking courses related to the simulation. |

|

The data regarding your trading activity and your answers to the survey in the BitCoin simulation will be used as part of a research project on behavioral finance carried out by Prof. Longin and Yuanpei Ding from ESSEC Business School. The data will be used anonymously. |

|

Yuanpei_Ding

|

|

Professor François Longin

|