New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

Better life for our beloved cats

Better life for our beloved cats

The BitCoin simulation allows you to experience a day of trading in financial markets. During the simulation, you will receive news about Bitcoin, a cryptocurrency traded on the SimTrade platform. You will be able to buy and sell Bitcoin. Your goal is to maximize your trading gain at the end of the simulation. At the start of the simulation, you own an account consisting of €50,0000 in cash and 2 Bitcoins. Given yesterday’s closing price of €25,101, the total value of your position is nearly €100,000. The duration of the simulation is initially set to 10 minutes which corresponds to a 24-hour trading day. You must complete the simulation for it to be valid for your grade. |

Your grade for this simulation (100 points) takes into account the following elements:

|

|

BitCoin is a decentralized digital currency that can be transferred on the peer-to-peer bitcoin network. BitCoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. |

|

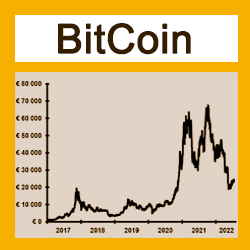

Among asset classes, Bitcoin has one of the most volatile trading histories. Bitcoin had a price of zero when it was introduced in 2009. It witnessed strong gains and suffered equally rapid deceleration for several years. In 2017, Bitcoin's price hovered around $1,000 until it broke $2,000 in mid-May and then skyrocketed to $19,345.49 in December. Mainstream investors, governments, economists, and scientists took notice, and other entities began developing cryptocurrencies to compete with Bitcoin. In 2020, the economy shut down due to the COVID-19 pandemic. Bitcoin's price burst into action once again. The pandemic shutdown and subsequent government policies fed investors' fears about the global economy and accelerated Bitcoin's rise. Bitcoin's price reached just under $29,000 in December 2020, increasing 416% from the start of that year. Bitcoin prices reached new all-time highs of over $60,000 in 2021 as Coinbase, a cryptocurrency exchange, went public. When the emergence of a new variant of COVID-19 continued to spook investors recently, Bitcoin dropped below $23,000 for the first time since December 2020. Bitcoin are currently priced at approximately €25,000. |

|

|

Today is an important day for Bitcoin, Tesla may announce to reject or adopt Bitcoin for payments. The moves raise questions around CEO Elon Musk’s recent behavior on Twitter, where he has been credited for increasing the prices of Bitcoin by posting positive messages that have encouraged more people to buy the digital currencies. Bitcoin prices surged to new highs following Tesla’s announcement, reaching a price of at least?. Late morning, the People’s Bank of China (PBOC) banned all cryptocurrency transactions. China has been one of the largest presences in the cryptocurrency community for some time. Therefore, it is evitable that the price of bitcoin fell dramatically upon the news. Besides, China is home to the largest group of bitcoin miners on the planet. In view of this fact, bitcoin production worldwide may change substantially. Investors are also aware that today at 5 PM the government releases < latest Fed report , which looks more positive on cryptos. The central bank appears set to make a massive policy decision on interest rates that will affect the already volatile cryptocurrency. Finally, the news that major exchanges are hacked will be announced by the end of the day. Hackers have made off with billions of dollars in virtual assets in the past year by compromising some of the cryptocurrency exchanges that have emerged during the bitcoin boom. Bitcoin’s uncertainty in terms of volatility significantly increases and the confidence of investors will be negatively affected. |

Teaching objectives: the Bitcoin simulation will enable you to become familiar with the key concept of market efficiency and how the news flow impacts the evolution of financial assets market prices. You will also discover key determinants of price change for a decentralized digital currency in the crypto market. Learning goals: the Bitcoin simulation will also allow you to acquire the following skills:

Before or after launching this simulation, you can obtain additional information on the financial markets by taking courses related to the simulation. |

|

The data regarding your trading activity and your answers to the survey in the BitCoin simulation will be used as part of a research project on behavioral finance carried out by Prof. Longin and Yuanpei Ding from ESSEC Business School. The data will be used anonymously. |

|

Yuanpei_Ding

|

|

Professor François Longin

|